This post may contain affiliate links or promotional content. We may earn a small commission at no additional cost to you. Information provided for educational purposes only. Please consult experts before making financial or legal decisions.

Consider sponsoring this post to help us share this knowledge with others! Email our team today.

Subscribe to Run The Money on Substack for more insights on financial resilience, audience growth, and building freedom in uncertain times.

Many expert investors will tell you to invest in gold. But what about silver? Like gold, silver is a precious metal. It doesn’t get as much hype as gold, because it isn’t as valuable. But could silver have other benefits that make it a better investment? This guide takes a look at some of the pros and cons of silver to help you determine whether it’s worth investing in.

Silver is cheaper than gold

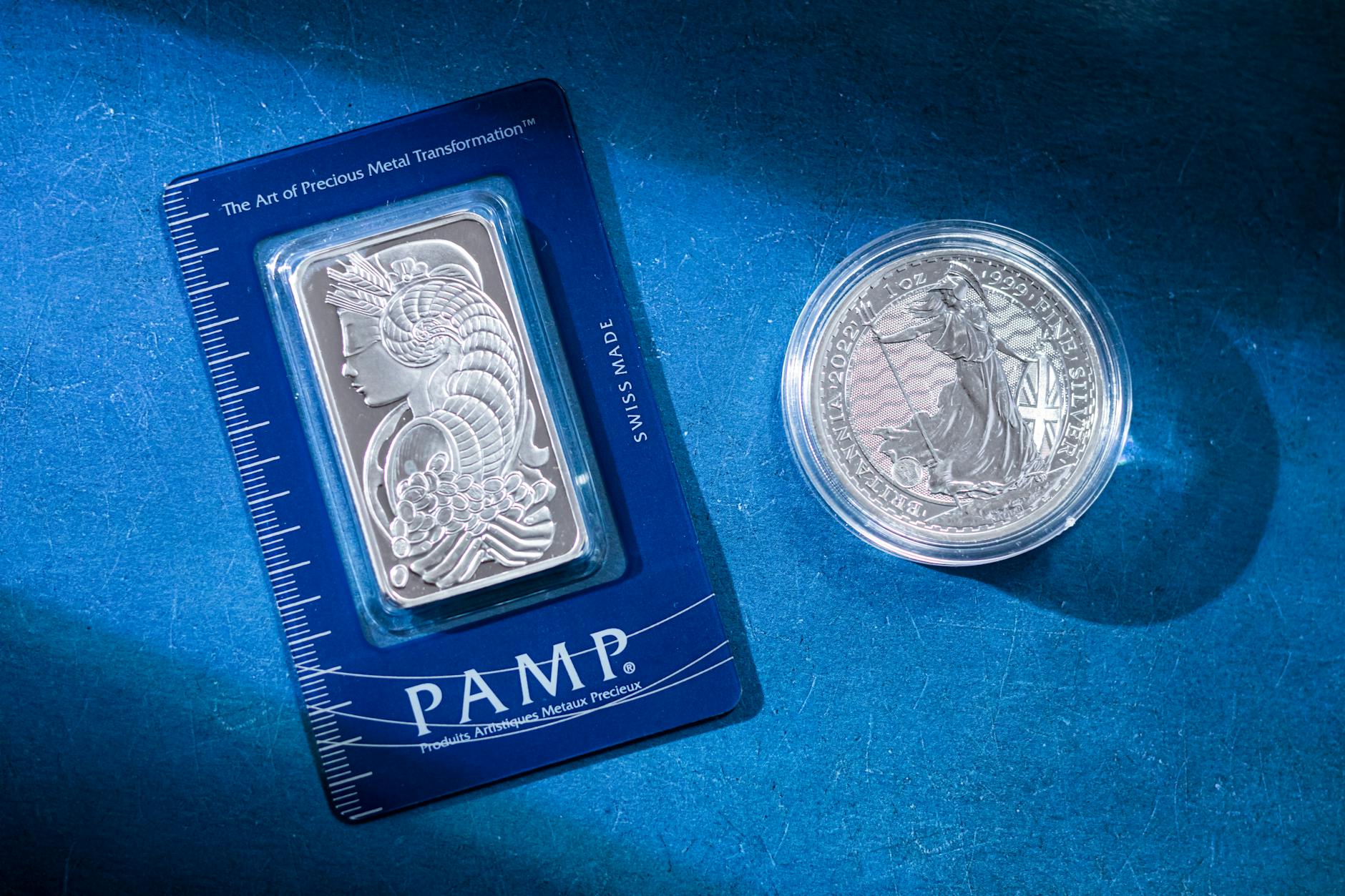

Gold has long been more valuable than silver. At the time of writing this post, the price of a gram of gold is currently £59.11, while a gram of silver is worth £0.75. In other words, gold is currently almost 79 times more expensive than silver. The reason why silver is cheaper than gold comes largely down to scarcity – silver is believed to be around 19 times more abundant than gold. Of course, silver is still relatively rare and valuable compared to other metals. In fact, it’s about 100 times more expensive than stainless steel. The advantage of silver is that it’s still affordable for most investors with small budgets to get involved in. You can buy silver coins online for less than £50. Most gold coins of the same weight cost just under £500.

Silver is more closely linked to stocks

Silver is used by many industries as a practical material. Examples include medicine, solar energy, photography and electronics. Gold is used less commonly by commercial settings and is instead mostly used in luxury consumer products. As a result, the price of silver is more affected by stock market changes because it affects the demand for silver. Gold on the other hand is known for remaining pretty stable during recessions. Those who have already invested in stocks may therefore find that gold is better for diversifying one’s portfolio than silver.

Silver has experienced much more dramatic rises in value than gold

Silver tends to have much more dramatic spikes in value than gold. Between 2008 and 2011, both gold and silver rose dramatically in value. But while gold rose in value by 166%, silver rose in value by a whopping 448%. For those looking to make a lot of money fast, silver can be a more popular option than gold – providing you buy at the right time.

Silver had also experienced much greater losses than gold

Of course, the downside of greater highs is that silver also experiences greater lows. Between 2011 and 2016, silver and gold famously fell in value. But while gold sank by -44%, silver plummeted by a jaw-dropping -71.8%. While silver has consistently climbed to a higher value after these lows, its volatility is enough to put many investors off.

Should you invest in silver?

Silver can be a better investment, but it depends on your goals and risk tolerance. Gold is generally more stable over shorter periods and is less affected during recessions. For this reason, it can be seen as the safer option. Silver’s benefit is that it doesn’t require a huge investment upfront. If you buy at the right time, you can also enjoy much larger short-term gains.

Some content on this site is contributed by partners or external sources. All submissions are reviewed for quality.

0 responses to “Is Silver A Better Investment Than Gold?”